In the face of market uncertainty, private credit has the long-held reputation of being a relatively stable, resilient investment offering. This reputation was tested through the first half of 2020 and into most of early 2021, when inflation was just a transitory phenomenon and didn’t require wall-to-wall coverage. Post-COVID, like the rest of world, we now contend with newer economic and geo-political (and climate) challenges. So it becomes the better question to ask – how attractive does private credit remain to investors when confronted with our new reality of rising interest rates, as well as the opportunities (and challenges) of a more open Australia?

Under the above circumstances, inflation is a double-edged sword to private credit. It creates both appealing and unappealing effects at the underlying sector level i.e. corporate, real estate and consumer segments.

In the past, I have mentioned how a large portion of private credit loans are floating rate, and therefore they generally provide some protection to investors against inflation (see this article). Based on the soundness of the lending practices of the originator, investors benefit from rising interest income and the underlying deals should ultimately generate higher yields. Across the investor class, this exposure should complement rival traditional fixed-income investment options.

However, rising inflation (and in this instance rising interest rates) will ultimately increase credit risk as borrowers are stuck with higher input costs and rising debt servicing requirements, creating substantial financial pressures.

In the last few months, we have seen countless instances of companies in the tech/construction sectors in particular, announcing layoffs as well as insolvencies. While devastating for those involved, we haven’t seen a chronic credit-induced crisis in either consumer or corporate balance sheets. If this translates, there will likely be greater emphasis on credit selection and a lower risk appetite.

This tells us very little about what is actually happening… but there are evident reasons to both invest and practice scrutiny when it comes to lending…a classic mismatch.

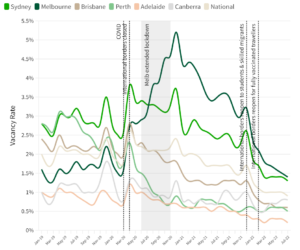

As for the economy: open borders mean more people, implying more opportunities for businesses as rate hikes are abated. While this is far from dismal, it’s still challenging. Private credit has a large exposure to the real estate sector, regardless of the type of development. So there are reasons to be cautious when it comes to lending. BUT we can confidently report that private credit isn’t being disproportionately affected and we’re not seeing a scarcity of demand/scarcity of funds entering the system. In the last couple of months, if anything, there have been headlines of developers returning deposits. Pervasive cost pressures are still prevalent in the sector, rather than dwindling demand.