At present investors of all asset classes are focused on inflation, as surging demand and warped global supply chain constraints drive up price pressures to new highs. This environment has brought me to a personal edict – focusing on what I’m able to control. Inflation and interest rates are determined by the market, and market outcomes do not come in pick-and-choose packaging. Therefore, isn’t it best to focus on what one can control when structuring deals?

An inflationary environment is not easy to navigate. It is fraught with uncertainty, especially when inflation is at a multi-decade high. Private credit and its underlying asset classes are no different. But a few rules of thumb apply – and if things are indeed historic in proportion, why not look at history for some answers…

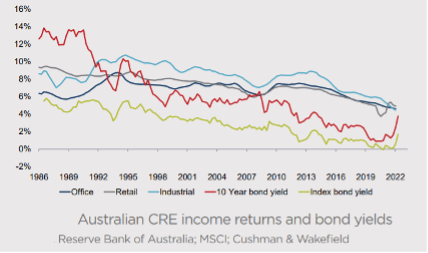

The recent inflation spike and upward movement in interest rates and bond yields has reduced the commercial real estate and bond yield spread. Looking at the nation’s history prior to the 90s, we can see that this is not new.

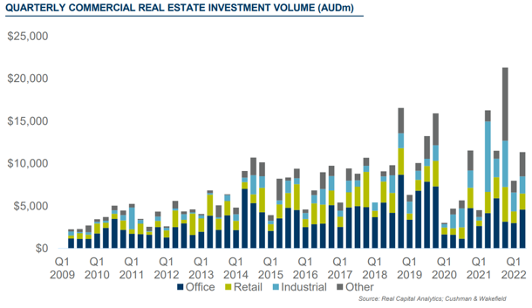

Investment volume in Australian commercial real estate remains solid, supported by factors including the relative strength of the Australian economy, relatively attractive returns and the reopening of the Australian economy following the COVID-19 pandemic. If anything, Australian commercial real estate transaction volume remained resilient in the June quarter of 2022, despite higher interest rates and bond yields. Transaction volume totalled $11.3 billion for the quarter, the second strongest Q2 on record, topped only by the $16.3 billion recorded in Q2 2021. The office sector recorded the highest transaction volume ($4.6 billion) of the main CRE (commercial real estate) sectors. ‘Other’, which includes hotel and student accommodation, had the second highest volume ($2.9 billion) followed by Industrial ($2.0 billion) and Retail (1.9 billion).

In private credit, success depends on quantifying investment risk, ensuring that risk is effectively priced, and managing changes in risk throughout an investment’s life. The same is true for the operators of the underlying assets.

For one, in the context of commercial real estate, shorter lease terms would allow rents to remain marked-to-market more often, thus benefitting the investor. Longer-term contracts for midstream investments could also offer some degree of explicit inflation management as revenues rise with higher demand. Leases or contracts with annual increments in-line with inflation and expense pass throughs again seem to work well. Assets in low supply market will likely benefit from a high growth and inflationary environment.

Other trends to consider (and arguably one could say are having more influence than inflation itself) are e/q-commerce and migration to urban/rural centres.

Finally, my tip is to avoid excess leverage, as assets with longer-term fixed rate debt benefit in an inflationary environment, as debt gets paid down with inflated dollars over time.

Australia has been a beneficiary of a powerful economic restart but disruptions will persist as global markets and investments react to a multi-speed, multi-region recovery. These dynamics present both challenges and opportunities for real asset investors around on how to identify secular growth themes, capitalise on structural trends and build resilience while aligning with long-term investment objectives.

Whether an investor is looking to construct higher income portfolios with cash flow generating assets or take on more construction/development risk with higher potential gains, or some combination of both, the versatility of real asset strategies is a particularly attractive characteristic in the modern investment marketplace.