With Australia adapting to a more COVID normal reality, the Leisure & Hospitality industry has been in steady recovery since mid to late 2021. This was aided tremendously by both state and federal-level covid policies, including the (earlyish) easing of various restrictive gathering laws and state-level dining vouchers – both designed to encourage more participation.

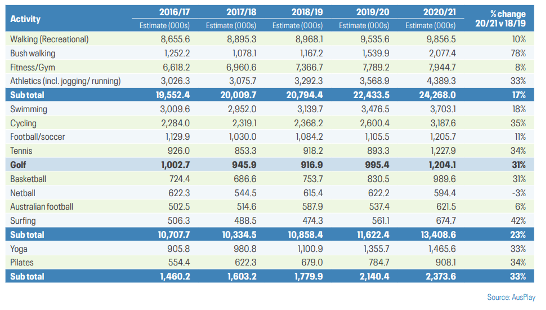

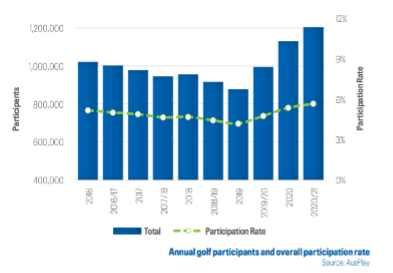

Households have been loosening their purse strings. We’re seeing a rise in spending in and around the home, as well as those that offered physical distance during the pandemic, and have continued in their popularity. Let’s take golf for example. For almost 20 years from 2000, participation numbers in Australia declined by an average of about one per cent per annum. But the increase of six per cent in 2020/21 is “game-changing”, and golf has continued to gain favour in the post-pandemic normal

The same level of optimism can be felt by the country’s diners, to the point where one can unambiguously rule out pre-pandemic levels as any plausible benchmark for comparison.

Now for the bad news. Headwinds to discretionary consumer spending are gradually mounting, with rising interest rates, cost of living pressures, a competitive rental market and, recently, stagnant wage growth. And all of this is just the demand side of things.

From the supply side of things, businesses that were impacted or closed during the pandemic continue to face unrelenting challenges. Approximately 300,000 workers left hospitality during the pandemic, due to closed businesses and irregular working arrangements. Closed borders and restricted travel have created an additional staffing shortage in an industry that has traditionally relied on working holiday tourists and international students to meet its staffing needs. But with travel interstate and overseas slowly improving, we can be optimistic about the future of hospitality supply.

Successful businesses in the hospitality sector have learned to be flexible in the face of uncertainty. This should also be the key attribute of their capital partners. Though recovery is difficult, it also offers a golden opportunity to revise outdated models of operation and offer better solutions. The appeal of private credit has been always about flexibility and responsiveness. With no two businesses being the same, companies across the sector have their own unique challenges of recovery. Tailored solutions offered by private credit lenders are unique to their client’s needs – just like your business.