The 1979 film, “Being There”, is the story of Chance, the gardener, whose world is defined by what he has seen in the garden. Following a chance encounter and some poor hearing, Chance the gardener becomes ‘Chauncey Gardiner’, and is welcomed into the upper echelons of society, business and government, giving gardening advice while people around him interpret it as economic prognosis.

Bizarre way to be introducing the article, you may be thinking. But opportunities will always be found amidst incoherence, and that’s what we’re dealing with here today. Once again, Australia’s economic and property conditions face uncertain times. It’s groundhog day and the usual suspects – geo-politics, rising inflation, rising policy interest rates and climate-linked challenges – are all at once coming into play. So let’s talk about it.

We start with the rental market, which continues to be of significance. Back in 2020 the concern was the ability of renters to continue to service their tenancy agreement, and landlords having a secure cashflow. Now the issue has shifted to renters not being able to find suitable tenancies/vacancies at an affordable price. 2022 has seen rental yields move at different speeds, depending on the balance between the property sale price and rental price growth. The residential construction industry continues to face challenges in 2022, leftover from 2021. Exacerbated by global and domestic macro-economic challenges, material costs have more than doubled, and the number of tradespeople has almost halved.

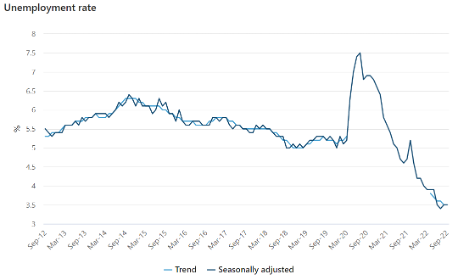

A higher cash rate and the potential of more successive (albeit, presumably smaller) hikes have created uncertainty and angst in most households. The share of disposable income that is moving to scheduled principal payment and mortgage offset accounts has spiked since mid-2020. Technically, a cash rate hike can be absorbed through a higher mortgage offset account (as a buffer), and the share in which income flows to either principal payment, interest, or mortgage offset changes. However, we are currently facing increasing costs in various aspects of life, which makes it more difficult. Policy rate (cash rate) expectations across different countries suggest a similar approach to ours. The USA, UK, Canada and New Zealand all have an aggressive cash rate hike expectation for 2022-2023, levelling out in 2024 and 2025. Along with the increase in living costs, the frantic pace at which this decision was brought forward has had a significant economic impact on consumers and businesses alike.

The phrase “unprecedented times” was common in 2020, as COVID-19 impacted every aspect of the economy and day-to-day living. Although the challenges are different, 2022 is vaguely similar – many replacing ‘unprecedented’ with ‘uncertain’. However tailwinds are on the horizon, as we hope for a resilient economy and low unemployment (not reliant on external stimulus) to remain steady.

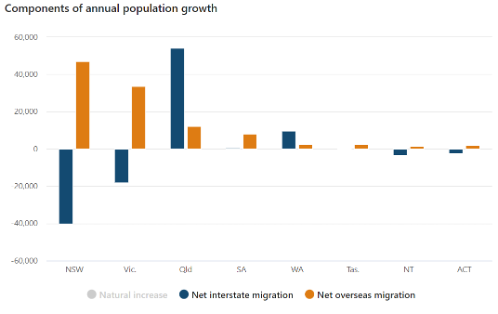

Like any other year, against the backdrop of global and domestic events, we have markets within markets moving in different directions and at different speeds. Consistent with 2020, there is now more interest in regional markets than in previous years. But this does not mean that capital city markets will be apocalyptic ghost towns. Sydney and Melbourne made recent headlines with a turn in their markets, including a decline in median house price growth.

Like any other year, against the backdrop of global and domestic events, we have markets within markets moving in different directions and at different speeds. Consistent with 2020, there is now more interest in regional markets than in previous years. But this does not mean that capital city markets will be apocalyptic ghost towns. Sydney and Melbourne made recent headlines with a turn in their markets, including a decline in median house price growth.

This brings me to my last observation. Our government’s policy of getting more people into the country means more than just housing and university seats for the incoming population. This is a holistic transformation of the Australian economy – everything from industrial warehouses to general storage facilities and other commercial forms of real estate must keep pace with the rising population. In addition, the niche sectors that exclusively serve the incoming population will continue to grow, including healthcare and medical facilities, multi-family dwellings (known in Australia as ‘build-to-rent’) and purpose-built student accommodation. This translates to a multi-sector boom, which itself requires more depots: warehouses to store the materials to build more roads, tunnels, bridges and airports.

Or as Chauncey Gardiner would say, amidst the incoherence, opportunities are in bloom.