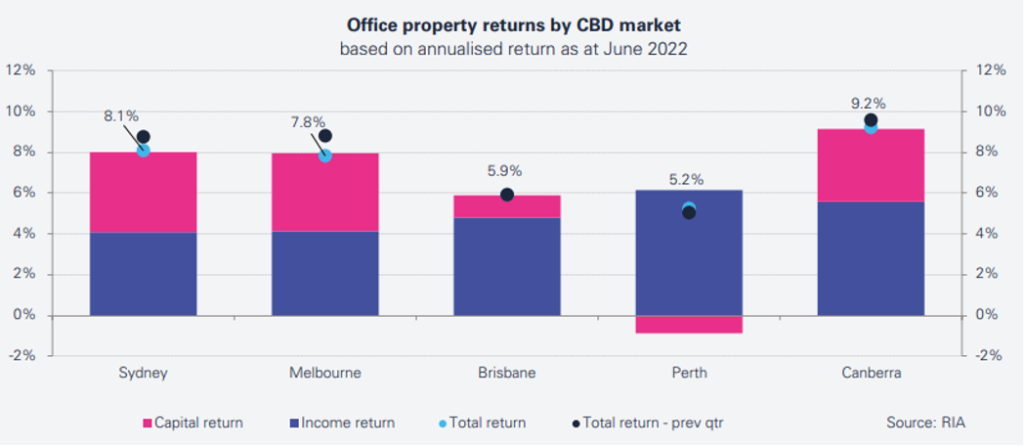

In the time of crypto and the metaverse, it’s important to blow wind back into the sails of commercial real estate investment. Despite an ever-expanding definition, we mustn’t forget commercial real estate’s one non-degenerative feature – it’s an income stream.

In commercial real estate investment, cashflow is underpinned by steady rental revenue streams, offset by maintenance costs throughout the life of the asset. This net revenue stream makes the sector appealing to investors of various appetites.

The modern commercial real estate sector is beyond just office space. There are niche subsectors within subsectors all of which share one common attribute – to utilize their services one must pay rent. Understanding how to better utilise and cost-out these spaces is an ongoing journey, underpinned by effects from residential market conditions, such as population growth, housing affordability and household formation. If the residential environment is favourable, we can expect strong growth in commercial markets over the medium-term.

The widely accepted WFH-model produced mixed results for Office property sectors. while the never-ending rise of eCommerce created equally mixed results for the Retail property sector. The moral of the story for investors is that businesses are responding to the changing fortunes – some, for example, by creating single facilities for multiple business purposes, such as a shipment centre with offices or a showroom.

Other opportunities to keep abreast of:

- For industries unable to operate on a WFH basis, think wellness and hospitality, these tenants continue to have healthy business margins being owned and operated only by experts in their fields.

- The newest contender from the Atlantic is the Build To Rent (BTR) subsector. The market has experienced strong activity over recent years. Currently, 13,000 units are being built across 40 projects.

- Australia’s fourth largest export is education, and international students need places to live. The short-term fix for student housing, traditionally, has been to cost-efficiently ‘modernise’ dated apartment units. However, given the size of demand is increasing, new builds will become the reality.

The net effect is that our present and future workforce need both more housing, and also more convenient housing, built with access to amenities and transportation in mind.

What to be weary of: rising construction costs can arguably be brushed off as a short term thing, but the absence of capital can not. State governments are each coming up with their version of how to assist the household with acquiring their first property, or even have more agency over their rents. But the long-term solutions have to be built on business fundamentals.

This brings me to my final topic, the appeal to the global institutional investor. The events at FTX, while a cautionary tale, touch on something equally vexing and incongruous. Star-studded (global) institutional investors investing in novel unsubstantiated businesses have felt their digital losses in the real economy. It’s a bit like having an imaginary friend stealing your real wallet. So next time (maybe this time) have a real customer pay for a real space for a real business with a real currency in a real jurisdiction.

Corporate real estate ticks those boxes.