Contrary to popular belief, Build to Rent isn’t all that new to Australia. BTR has been around since 2017 and has steadily gained coverage in the Australian public domain ever since. Referring to apartment blocks or larger developments purpose-built for rental occupation and held in single ownership as long-term revenue-generating assets, BTR represents a major departure from traditional Australian models of housing development and ownership. What is different in 2022 is the conflation of ongoing socio-economic trends centred around affordability, demographics, and financial feasibility.

The developer-lender relationship requires recalibration, specifically around the topics of investment finance, corporate structures, and property and tenancy management practices. While new and exciting in nature, the broker must contend with the same perennial question from both counterparties – “Is it worth it?”

The development industry has been increasingly conscious of declining home ownership affordability and equally declining ability to service home ownership. These are trends that may point towards the need to re-align industry output. While it is plausible that rental demand has been artificially boosted due to unaffordability reasons, there are other lifestyle matters that are relevant; including the shift to flexible working, rural-interstate migration and the increasing allure of city living amenities

A new housing asset class, and more specifically a rental asset class, addresses both the lifestyle and financial challenges faced by the new modern consumer. Additionally, BTR offers long-term tenure security in a way that traditional private rental does not – a tenant saving for a mortgage will benefit from the absence of house-move costs otherwise incurred in a market where the average tenancy lasts 2.5 years. Then there’s the question of uncertainty of pre-sales and EOIs. A BTR project provides developers with some protection against these traditional metrics of project hurdles. So, to my developer friends and clients, is the sector worth a second glance? Definitely. The question is how it all gets funded.

BTR development carries a completely different risk profile and business model. Merely looking beyond existing finance providers to a wider range of financial institutions, including superannuation funds, foreign pension funds and sovereign wealth funds, would be insufficient at best. What is required is the management of inter-institutional relationships.

Build to rent is typically characterised by stable albeit relatively low rates of return when compared to other asset classes such as commercial office. The ‘first principles’ of the BTR offer are ‘amenity, size, and service’. Build-to-rent schemes require a minimum threshold of 200-plus apartments to gain efficiencies of scale and meet long-term running costs. It is also important to rationalise the apartment mix and size to meet the target demographic. Well-designed community spaces together with attractive amenities can improve the building experience, reduce tenant turnover, boost investor appeal and attract higher rents. From a lender’s perspective, the quality of lifestyle offered by the project is almost as relevant as the financial metrics and feasibility of the project.

For developers, it is essential to offer and implement effectiveness in integrated property management, whereby all rented units are owned or managed by a single landlord. Additionally, BTR projects need to be mindful that competition isn’t only the building down the road – both challenges and opportunities are equally derived from changing demographics, especially in emerging areas. From an investor’s perspective, both local and foreign investment could now enter the Australian housing market through fund investment rather than investing in full residences. BTR brings those alternative investment options with low risk and a stable income stream.

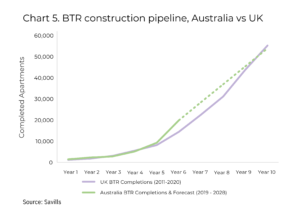

The BTR market is starting to find its place within the housing spectrum. Australia’s small and fragmented market will change dramatically over the next 5 years, with the annual delivery of BTR apartments expected to reach the tens of thousands. So, the opportunity is there for all market participants.