The appeal of private credit is widely echoed amongst borrowers, with the majority attracted to its flexibility. Lately, however, what’s most talked about when it comes to private credit is SIZE.

Private credit investors are embracing larger transactions and new structures, expanding outside their regular base of SME sponsors. While this segment continues to evolve and become more mainstream, lenders are offering more than flexibility. Commercial real estate private debt lenders are supporting asset owners execute development and construction projects by,

- Financing on accommodative terms using private credit (i.e., on higher loan to value and loan to cost and lower presales/leasing).

- Obtaining finance more quickly.

- Exploring different capital stacks (i.e., junior/mezzanine debt and even portfolio loans).

- Repositioning poor performing assets or strategies.

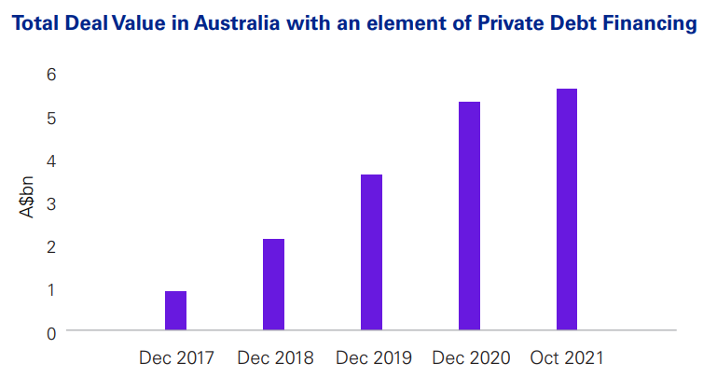

Preqin Pro 28 February 2022, in Alternate Captial: Funding options for business growth and investment (KPMG)

Both lenders and investors are increasingly keen on advancing the size of financings, in competition to the banks active in this space. Lenders have also raised equity mandates to enable broader access to the growing property market.

If this is sounding too good to be true, let’s look at the facts. 2021 easily registered as a record year for Australian general debt market transactions, on par with broader global credit activity. Globally since 2010, private credit under management has gone up 30 folds, representing the third largest asset class in the alternative investment space, after private equity and real estate. In Australia, this market now stands at a total of A$133bn, growing 20% from the previous year. Real estate-related transactions, including development and construction financing, account for roughly 38% of AUM (about A$50bn) and continue to be the fast-growing segment of the private credit market.

Further, Australia’s local capital markets are still largely bank-funded, meaning they present an important growth opportunity for private credit products, offering increased flexibility for leverages, covenants, amortisation profiles, and duration in return for yield premiums.

So in summary; transaction sizes have gone up, private credit is becoming private capital (and not just debt-outstanding), construction and development funding is fast-growing, and the door is being opened for other local markets, such as corporate refinancing or private-equity-backed mergers & acquisitions.

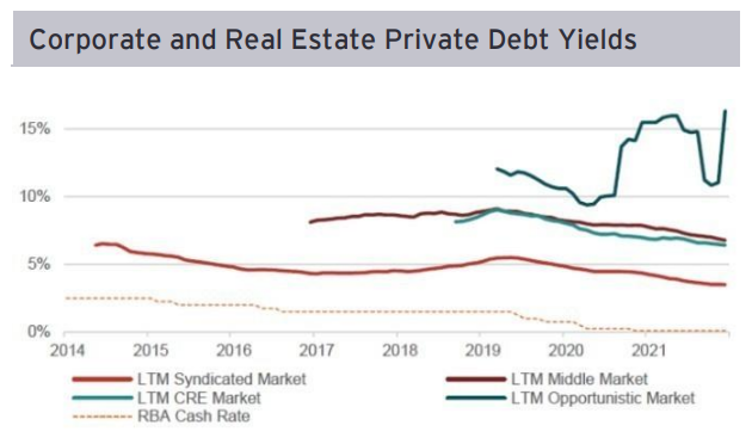

BondAdviser, Metrics, Qualitas, Altor Capital. As at 9 February 2022

Institutional lenders are working up an appetite for Australian private debt, looking deploy available capital and deliver a good relative return. The current stability in market spreads (shown above) attracts more investor capital, meeting the demands from Australian businesses and corporate borrowers looking to explore alternative funding options.

A flexible mandate is critical when investing across the capital stack and private forms of capital are no different. Being truly opportunistic is as much about avoiding mistakes as it is about finding the most attractive investments, with broader opportunities across sectors reducing pressure to deploy capital in crowded sectors. Investors and lenders, after all, lend to the needy.