If you thought your friend was antsy on an empty stomach, wait till you meet your lender.

What I mean by this – everyone from your favourite non-bank lender (NBL) to the cold callers on the phone requires balance sheets to determine the number of loans they can write, the size of the loans and their serviceability. For banks and non-banks alike, balance sheets drive income statements. For lenders, it’s essential to have a healthy balance sheet – aka, a full and happy stomach.

In non-bank lending, the famous flexibility and quick turnarounds rely on having the capital to disburse. And NBLs have the unique challenge of acquiring capital to support their clients’ demands without the backing of any consumer deposits, which the banks benefit from.

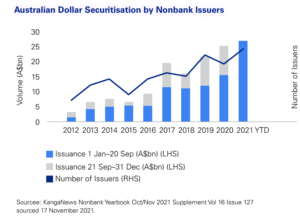

Traditionally the most relevant source of capital for non-bank lenders has been their access to private credit. However, the recent successes of the sector have brought in various interested asset managers, both local and overseas keen to invest. The scale of some NBLs has allowed them to access public markets, with lenders either going public themselves or issuing securitisation notes. While not completely unheard of, the recent pace and volume in particular is a testimony to the success and wider adoption of the sector.

While it’s true that an overwhelming majority of non-bank securitisation issuances still comprise residential mortgage lending, it’s noteworthy to point out that the market has grown fourfold since the last decade. It now has close to 24 individual participants. What we’re seeing is that the non-bank universe can be as niche as capital that is privately funded, or something more mainstream as securitised debt. And with size comes economies of pricing – the bigger you are, the cheaper your cost of capital.

Undeniably, the availability and the cost of financing are two of the most important drivers in an NBL’s business. With newer sectors translating into newer lending opportunities, NBLs now have the option to diversify their funding based on their size. With non-bank lending becoming mainstream, investment in non-banks is gradually becoming the same.

Hungry yet?